Repositioning Properties for Success

REalta Group

Property Repositioning Experts Creating Opportunities

REalta Group is an entrepreneurial commercial real estate firm that applies its decades of experience to identify, reposition and optimize the value of properties for the benefit of partners and investors.

REalta Group has vast experience as both principals and service providers in acquisition, asset and property management, leasing, development, project management and dispositions.

Investments

High Investment Returns and Capital Preservation

REalta Group and its partners in their careers have been involved in more than $3 billion in asset value across 30 million square feet of properties around the country. Partners and their investors have been able to leverage REalta Group’s experience and inherent efficiencies as a fully-integrated provider of the services and expertise that drive success.

REalta Group Difference

Experience

We have decades of experience in creating value nationally across different product types.

Hands-on Leadership

We are actively involved in every deal and every detail.

Principal Investment

We invest alongside our partners. We explore every option with a forward-thinking macro and micro approach, making every decision like you would – from an owner’s perspective.

Asset Portfolio Results

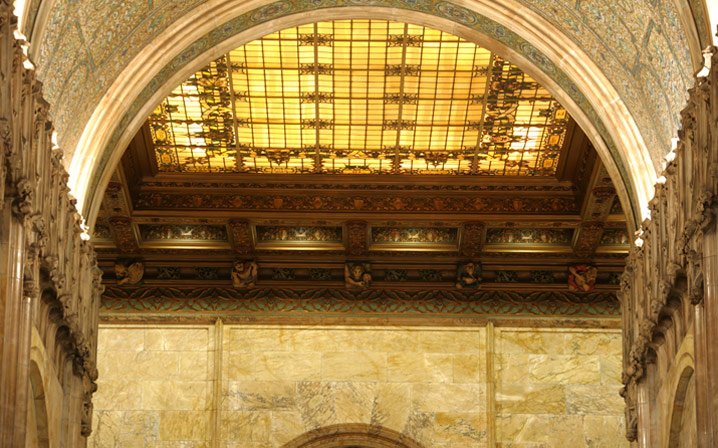

The Woolworth Building

233 Broadway, New York, New York

In the beginning of 2001, with the economy in a downturn, the owners of the Woolworth Building, a 1,000,000 square foot historic landmark building in New York’s Downtown Financial District, were facing vacancies and several million dollars in payables. The tower, 15% of the building, was vacant.

REalta Group was brought in as the Asset Manager to formulate a plan to lease-up the building, propose a use for the tower and work out the payables. Then came September 11, 2001, and the situation got worse. The Woolworth Building is located only 2 blocks from the World Trade Center site.

Then new tenants came in, including New York University, Brown University, Moneyline, the General Services Administration and The New York City Police Pension Fund. Below grade levels were developed into a parking garage. The payables were paid, and new interior construction of more than $15,000,000 was completed.

The mortgage was refinanced in excess of the original amount and continues to provide distributable cash flow. The tower of the building (approximately 110,000 square feet) was sold in 2012 to a developer for condo development.

Today REalta Group oversees all asset management aspects of this historic building including construction, on-site management, negotiating leases, budgeting, interacting with tenants and overseeing extensive preventive maintenance, including the building’s decorative terracotta facade. The base of the building (850,000 square feet) is 99% occupied with rental rates in the high $50s per square foot. All of this was accomplished in the pursuit of one goal, to ensure that the Woolworth Building maintains its stature as an icon in the market.

Industry City

Sunset Park, Brooklyn, New York

Industry City at Bush Terminal is a 6.5 million square foot complex of industrial, office and retail space in a bustling creative business hub that is comprised of over 30 acres of historic Bush Terminal along Brooklyn’s Sunset Park waterfront in New York City. Industry City is one block from the 36th Street stop on the D, N, and R subway lines; one stop to the LIRR and two stops to Manhattan. The site is also two blocks from the Gowanus Expressway exit on the BQE.

Commercial Real Estate Management: Industry City

Bruce Federman oversaw the repositioning of the asset, driving NOI from $26 million to $41 million in a 5-year period. Additionally, the team repositioned and restructured the loans governing the subject’s assets. Industry City houses a diverse mix of businesses that encompass traditional industries such as textile and other light manufacturing, data centers and warehousing, as well as a growing base of creative businesses. Owned by Industry City Associates, the 16-building site has undergone extensive capital improvement and modernization, including newly renovated lobbies, automatic passenger elevators, new energy-efficient double-glazed windows, updated lighting and electrical service.

Commercial Real Estate with Industry City

Industry City offers commercial real estate leasing opportunities featuring units ranging from 500 to 150,000 square feet. Industry City’s wide variety of units contain fully integrated sprinklers, have easy freight access, multiple loading bays and over-sized freight elevators, 200 pounds per square foot heavy floor loads, 12- to 14-foot ceiling heights, and extensive electrical and fiber optic capacity. The highly flexible space, including pre-built and build-to-suit possibilities, has competitive pricing, on-site management, 24-hour security, ample parking, and rent payable by credit card. Additionally, Industry City Associates began developing a creative workshop community in 2009 by building 30,000 square feet of creative studios for rent, conducting various creative events such as film screenings and art installations and holding Brooklyn’s Fashion Weekend, a bi-annual exposition showcasing the work of local and international fashion designers. As of December 31, 2011, the creative workshop program has grown to over 125,000 square feet.

The Bush Terminal site has tremendous historical significance for New York City and helped establish Brooklyn as a major seaport destination on the Brooklyn waterfront.

Industry City Bush Terminal History

Constructed by Irving T. Bush starting in 1895, the site expanded to be the largest multi-tenant industrial property in the United States. At one point, the site employed as many as 25,000 workers in shipping, warehousing and manufacturing for the textile, automotive and machinery industries, among others.

Bush Terminal contributed to the war effort during World War I and World War II, and housed illustrious tenants including Topps, which produced baseball cards at the facility. Bush Terminal operated through 1974 and was renamed Industry City in the mid 1980s.

The Future of Industry City Bush Terminal

Dedicated to preserving Bush Terminal’s industrial heritage and innovative spirit while providing a destination where 21st century businesses can prosper, Industry City has launched a full-scale 10-year renovation plan that will include repaving the streets that separate the property’s buildings, bulkhead renovation to the buildings that line the Brooklyn waterfront, installation of overhead power distribution and buss ducts, and a complete modernization of the property’s 150 elevators.

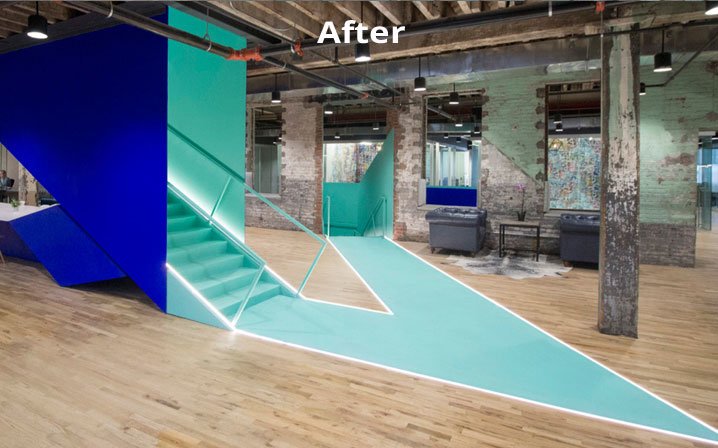

First Center Office Plaza

26911 Northwestern Highway, Southfield, Michigan

Asset managed since 2007 by REalta, this 640,000 square foot office complex is comprised of four buildings joined together by a common atrium. Coming out of the recession that started in 2008, the office market had generally experienced high vacancies, and this property was more than 50% vacant. In 2014, the office market in southeastern Michigan started to experience a significant revitalization with positive absorption.

In order to change the view of the property for both the brokers and the end users, the property needed to be repositioned and given a facelift to be re-presented to the marketplace in a fresh new way. First Center offered an excellent Value-Add opportunity. In Q4 2015, REalta was able to source a third party institutional investor to purchase the note on the property at a discount (as well as the Troy Industrial Portfolio mentioned below) and bring fresh capital to the property in order to reposition and fund the improvements and tenant-related costs. REalta spearheaded improvements at First Center which includes repaving the parking lot; painting of the building’s exterior in fresh vibrant colors; new vestibules and entranceways; revamped common area space with the focal point at the center of the atrium which work includes demolition of fountains, new flooring and furniture; and redo the secondary hallways with new flooring, wallpaper and lighting.

In October 2017, less than 2 years after the property was recapitalized, the property was sold to a significant healthcare company in Michigan who wanted to consolidate its operations into First Center and make the property its new Headquarters. The sale represented a significant profit to the ownership group.

Troy Industrial Portfolio

24 buildings across Troy, Michigan

92 Third Street

92 Third Street, Gowanus, Brooklyn

In January of 2014, Bruce Federman and his partners at LIVWRK bought the property for $20.34 million, then a submarket record. They then embarked on a $12 million gut-renovation targeting creative office tenants.

Before obtaining certificate of occupancy, the office space was fully leased to two tenants: Genius Media, an Andreessen Horowitz-backed internet company and a co-working operator. These leases were signed with the highest per square foot rents ever achieved in the Gowanus. In July of 2015, less than 18 months after purchasing the property, they sold the fully-occupied building for $73 million.

160 Van Brunt Street

160 Van Brunt Street, Red Hook, Brooklyn

In June of 2014, Bruce Federman his partners at LIVWRK bought the property for $21.50 million, then a submarket record. They embarked on a $16 million gut-renovation targeting TAMI tenants. Midway through construction, the ownership group signed Tesla Motors as an anchor tenant. Tesla is using the space as a showroom, repair facility and office. It is their largest east coast location.

As of January 2018. the construction is complete and they have signed leases with Starbucks, NYU-Langone and Stink Digital, a digital media agency whose clients include Facebook, Adidas and Google. Ownership is in talks for the remaining 30,000 sf with various tenants.

Parklawn

5600 Fishers Lane, Rockville, Maryland

REalta Group has been the owner’s representative for 5600 Fishers Lane in Rockville, MD, for almost ten years. The property consists of a 1,300,000 square feet single-tenanted office building entirely occupied by the U.S. Department of Health and Human Services, and two adjoining parking lots.

REalta Group, involved from the acquisition with the management and operation of the building, played an integral role toward the redevelopment plan and entering into a joint venture with a well-known land developer, JBG Companies, with grassroots in the DC market. The joint venture was able to finalize lease negotiations with the government for a 15-year lease renewal. This paved the way for the partnership to work on the complete renovation of the existing 1,300,000 square foot building as well as construction of a new 500,000 square foot building on a portion of one of the parking lots, which has also been 100% leased through the government.

As part of the renewal, ownership agreed to completely renovate the building and transform it into a sustainable, Class A trophy office building.

The 18-story building has undergone a complete modernization including a curtain wall re-skin, all new building systems, and the introduction of a 14-story atrium. New cores were built within the atrium to provide the facility with a wide-open floor plan within a 65-foot-wide office building to afford direct access to natural light for nearly 100% of the office space. The facility attained LEED Gold status. The total budget for these projects was approximately $300,000,000.

Long Island Industrial Portfolio

36 buildings across Nassau and Suffolk County in Long Island, New York

As asset managers who were also investors in the Portfolio, REalta was directly engaged with management and leasing. The Net Operating Income increased by $4,000,000 along with significant property upgrades. REalta employed a hands-on strategy including ongoing capital investments to assure the properties continue to provide upgraded facilities for the tenants’ use. A new initiative was implemented to controls real estate tax increased. These ongoing capital improvements and cost controls, particularly with respect to real estate tax increases, have produced increased rental rates and occupancy levels, and therefore, additional cash flow.

National Industrial Portfolio

36 Buildings across 14 different states in the United States

Stephenson Buildings

Troy, Michigan

500 and 750 Stephenson are two office buildings that are 70,000 and 140,000 square feet respectively. The properties were purchased in 2019 with low occupancy and in the need of major capital improvements in order to reposition the buildings and be able to re-tenant the spaces. REalta Group, as the manager, handled the planning process and executed on significant improvements including painting the exterior of the building, new parking lot and sidewalks, and completion of interior renovations. The interior renovations include the lobby, common areas, restrooms, interior wayfinding and signage, and the creation of first-floor amenities such as a tenant lounge, 24-7 self-service micro-market, and a conference room. The renovations were recently completed and the market feedback has been very positive. The building is now well-positioned for lease up to prospective tenants.

Acme Hampton Roads Portfolio

Hampton, VA

The Acme Hampton Roads Portfolio is a 1,320,000 square foot Class A office portfolio located in the heart of the Hampton Roads in Virginia. The portfolio is composed of 22 properties that are multifaceted for both large or small tenant requirements. The current tenant roster boasts businesses that have a local and national presence across many different disciplines. After ACME acquired the portfolio in 2019, REalta Group was hired as the Asset Manager for the portfolio to preserve and protect the assets and its value. The properties are adjacent to major interstates and roadways which makes accessibility very easy and desirable to tenants. Hampton Roads continue to be a rapidly growing market that is centrally located on the east coast and features excellent local amenities.

Soho Mews

311 West Broadway, New York, New York

After approximately two years of project pre-development, the developers of Soho Mews needed an experienced owners’ representative to expedite their project.

To ensure that schedules were met, REalta Group organized the project, interacting with the entire project team on a daily basis. REalta Group participated in the construction process to ensure the job would be completed on budget and on time.

REalta Group worked through the landmarks and city planning council approval process, and participated extensively in budget review bidding and awarding for construction and marketing. REalta Group supervised the preparation and completion of the condo offering plan, prepared the project budget for the construction lender, and negotiated the terms of the construction financing. REalta Group worked directly with sales and marketing to brand and market the building, including weekly sales meetings, and was involved in all sales negotiations through completion and closing.

All 68 units of this luxury condo development were successfully sold for an average price per square foot of $1,700. The loan was paid off and all equity returned after selling the 44th unit. The other 24 units have been sold and represent a substantial profit to the developers of the project.

Leadership

Brad Pincus

Brad founded REalta Group, one of the country’s most respected Asset Management firms, in 2005 with his father, Barry Pincus. He is responsible for a team of top professionals who manage commercial and industrial assets in New York and throughout the nation. Brad handles the day-to-day asset management operations of REalta including acquisitions and dispositions and works closely with the property management and accounting team to ensure that everything is completed in a timely and orderly fashion with the proper checks and balances. He also interacts with the brokerage teams for each property to track deal flow and activity and negotiate deal terms. He protects asset values for owners and investors of such trophy properties as New York City’s Woolworth Building.

Barry Pincus

An innovator in Asset Management services, Barry Pincus brings more than 25 years of experience to his profession. Working on behalf of owners, developers and private investors, Barry spearheads an Asset Management firm responsible for several million square feet of commercial real estate nationwide. Whether he is protecting an iconic asset, such as New York City’s revered Woolworth Building or overseeing the management of national industrial portfolio Barry brings an unparalleled breadth of knowledge and personal and professional care to each assignment.

Barry began his current career path in 1985 when he became actively engaged in the development, acquisition, refinancing and operations of several assets. Over the years, the key to Barry’s success has been his strong and loyal relationships with investors, lenders and brokers such CBRE, Cushman & Wakefield, Colliers, and Newmark.

In 2005, he founded Phoenix Asset Management, with his son Brad. Together they have developed a national business, adding new service lines and expanding an impressive client base. In addition to trophy assets and signature projects in New York City, Barry is involved in the acquisition and management of commercial and industrial properties as well as new development projects in seventeen states across the country.

Bruce Federman

Bruce has more than 25 years of experience in all aspects of real estate asset management. As an owner, developer and asset manager, he offers an astute perspective to his clients given his ownership participation in various real estate portfolios. He understands the importance and impact of maximizing the value of the asset as well as increasing cash flow while keeping the owner’s goals at the forefront. He prides himself on using his expertise to provide guidance and superior service to all of his clients as if he owns the assets.

Bruce is known as a pioneer in the commercial real estate sector for his unique foresight for current and future use of industrial real estate assets, evolving his business plans to coincide with the changing economy and climate of the real estate market. As one of the largest industrial landlords in New York State, he had the insight to alter the concept of light manufacturing in Brooklyn’s Industry City to include technology start-ups and art studios. Bruce envisioned a change from historical, manufacturing uses to mixed-use purposes in what was a strong manufacturing culture dominated by the garment district. This generated new demand by different business lines that were not part of the community beforehand. His ability to see the bigger picture and adapt accordingly is what is most attractive to his partners and clientele.

Bruce graduated from the State of University of New York at Buffalo and continued his education at New York University in New York City. He entered the real estate business in 1984, becoming an industrial broker for Helmsley-Spear, Inc., working on projects on the west side of Manhattan and in Brooklyn. He became the Director of Real Estate for Industry City in March of 1986, and Managing Member. Along with various partners, they have amassed an impressive portfolio.

Steve Kalabat

Steven brings over 25 years senior level experience in real estate, merchant banking and private equity. Steven was responsible for growing his holdings through the acquisition, development and management of commercial real estate property. He began his career serving as Vice President of Business Development at Rosscape, Inc., of Beverly Hills, CA, and functioned as a leading principal in originating acquisition and development finance for multi-billion-dollar infrastructure and energy related projects worldwide. Steven also served as managing principal in Alomar and Associates of Beverly Hills, CA, in the $4 billion Daewoo Electronics buyout syndication deal. Since 2000, he has grown his real estate holdings from start-up to over two million square feet of commercial real estate property with his close syndicate of real estate partners. Additionally, Steven has raised funding for and participated in many venture capital transactions yielding success, including National Processing Systems, LLC, processor of $1 billion in annual credit card volume, Xtendwave, LLC, developer of a telecom chipset which is targeted at wide insertion inside of the national copper telecom network, Clear Publications, LLC, publisher of Clear Magazine sold in 26 countries; Employees Only Solutions, LLC, $10 million volume human resource and benefits provider; and TMG Partners, owner and operator of 100 AT&T wireless retail stores with $50 million in revenue. He also provided consulting on the strategy which doubled the revenue of the largest shopping mall media provider in North America, serving over 300 regional shopping malls.

Steven has an MBA with concentrations in finance and international finance, while attending DePaul University and University of Chicago, Booth School of Business. He received Graduate with Distinction Award, which is the top academic honor award, and Delta Mu Delta Honors Society. Additionally, Steven sat on numerous corporate boards and is active in International Council of Shopping Centers.